p{font-size: 12px;line-height: 20px;}

.footnote{margin: 50px 0 30px !important}

.footnote p{margin: 0;}

.footnote p:nth-child(1):before{display: block;content: “”;width: 150px;height: 1px;background: #000;}

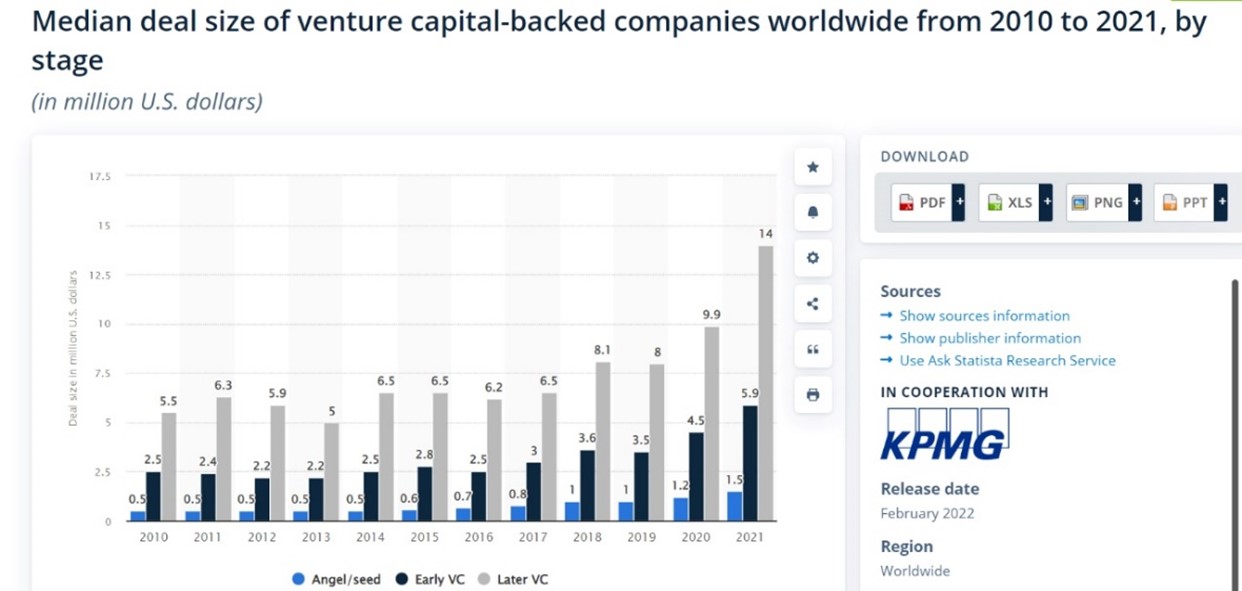

1) The ticket size of VC gets bigger

– Recent data 2)shows that the median ticket size of venture capital firms in the United States has hiked up in the last 10 years. For example, the median size of VC investment in angel/seed round in 2012 was just half a million dollars. Nowadays, it is 2 million dollars. Startups in later stages of investment got funded around 6 million dollars in 2012. Now, the figure has increased to 16.2 million dollars (median number).

(source: Statistica in cooperation with KPMG)

– Most of those investments belong to startups in Silicon Valley or to similar startup-hubs in other regions. The more investments those startups received, the more growth they could acquire in short periods of time.

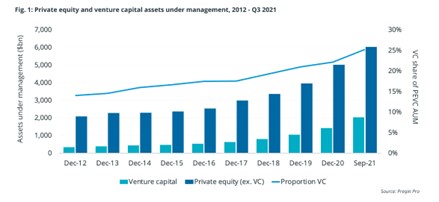

– Top VC firms have larger AUM (asset under management) than ever before. The AUM of VC firms recorded by Preqin exceeded $2 trillion as of September 2021. The ratio of VC’s AUM compared to PE(private equity)’s has grown up from 15% to 25% in the last 10 years 3). For example, Sequoia Capital 4), one of the biggest VC firms and invested in big tech companies such as Yahoo from those companies’ inceptions, has AUM of $80 billion5) . That AUM figure might be dwarfed by the size of big PE firms such as KKR, but the number is still very impressive. Unlike its competitors, Sequoia Capital has been able to find the best deals due to its size and network. By bringing much-needed financial and professional resources to startups, VCs help their portfolio companies thrive.

2) The investment range of PE firms gets wider

– The growth of VCs and their investment size has reshaped other investment ways as well. The liquidity in the global markets created by the 2008 financial crisis’ quantitative easing policy allowed firms to look for deals with lower expected returns than before.

– Awash with liquidity, private equity firms made forays into fast-growing Silicon Valley. As a result of these movements, the investment range (span) of PE firms became much wider. Eventually, they were able to invest in very small tech firms as well.

– Since they are not quite suitable for early-stage investment, many of them set up their own VC firms or similar investing arms for this more specialized area. For instance, Millennium Technology Value Partners 6), a Blackstone-backed VC, invested in Facebook and Twitter from their earlier stages. Globally renowned PE firms and investment banking companies now have their own venture capital entities, not only to look for higher returns but also to find better deals (so as not to miss out on investment opportunities).

3) Everyone is looking for the same area – tech

– Now everyone shares the same target – creating the next Google. The number of unicorns is 10 times bigger than it was 7 years ago. According to CB insights, the collective value of the more than 1,000 unicorns in the market is almost $4 trillion including Bytedance – the owner of Tiktok company – and space X. Their speed of growth would have been unimaginable only a few years ago.

– From a traditional point of view, private equity firms invest in bigger companies at later stages compared to venture capital firms. But in the search for the next Googles, both compete to make deals.

– Rapidly growing startups in Silicon Valley call for more money from VC firms that invested in them at earlier stages. It used to be understood that VC firms were not likely to invest more at later stages, including pre-IPOs since that is their time to exit and make a profit.

– However, nowadays, it is more likely for those VC firms to make follow-up investments in the same companies, by way of accepting capital calls for next round of later stages. Alongside the increase in liquidity in the market, a higher number of technology startups are privately held than ever before. This liquidity allows those VCs to take the chance of additional investments in the same companies they already know well. As a consequence, the line between PEs and VCs is blurred.

– The changing trends in the investment scene drive many investment firms to harsher competition over the same deals. Big VC firms such as Sequoia Capital now have so-called ‘satellite’ VC firms around them. Small VCs search for the same deals but they are not likely to get a chance to invest in promising startups. Hoping to get better deals down the line, some small VCs take bad deals from bigger VCs on purpose.

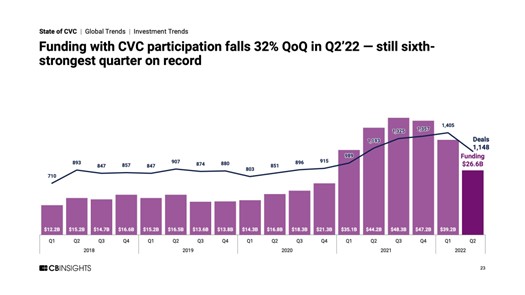

4) Winter is coming

– Following the booming cycle in the last 10 years, the market is now facing severe headwinds. The Nasdaq Composite index has fallen from 16,212 on November 19th to 12,390 on July 29th, losing one fourth of its value. The public market disturbance will lead to a big downfall of total value of startups backed by VCs 7).

– Last quarter of this year (2022 Q2), CVC firms (Corporate Venture Capitals) withdrew from big deals. They stopped investing in big deals as much as they had before(footnote). CVC firms usually have a bit more of a conservative attitude than independent (not attached to big companies) VC firms since they do not chase higher returns. CVC firms’ withdrawal from big deals is surely a signal of market change.

– Raising funds became a pretty difficult task for early-stage startups. Lots of startups are now regretting that they didn’t raise enough money from investors last year. They feel that the window of opportunity to raise funds is closing now.

– The downturn also would be an opportunity for some startups without financial difficulties. The chances of finding strong talents in market are higher. If they hire experienced engineers from big tech firms for lower salaries than before, it might boost those companies’ speed of growth.

5) A new steppingstone for Korean startups